Investor Info

Welcome To Eagle Plains Resources

Eagle Plains in 120 Seconds

Corporate History

Eagle Plains Resources is a Canadian based mineral exploration company with over 35 mineral exploration properties in western Canada.

Eagle Plains has been operating since 1992 and publicly traded since July 1995. The management is made up largely of geologists with decades of experience and has a proven ability to develop joint venture partnerships. An in-house team of geologists and technicians enable us to manage this large portfolio of projects.

Objective

The primary corporate objective is to enhance shareholder value by making precious- and base-metal deposit discoveries. To best achieve this objective we employ a risk-averse strategy to this risk-intense business by utilizing joint-venture participation.

We also continue to add to our project portfolio by acquisition of early-stage exploration properties. Click on the link for an explanation of the grass roots exploration process.

Exploration Projects

Eagle Plains properties include prospects for gold, silver, copper, zinc, lead, uranium, lithium, molybdenum, rare earth minerals and industrial minerals. Information regarding each of our exploration properties can be found on the projects page. You can sort the properties to be viewed by jurisdiction, mineralization type and availability for option.

Contrarian Strategy

The majority of Eagle Plains mineral exploration properties have been acquired through staking during industry downturns, these include multiple projects that have had millions of dollars in exploration expenditures by previous operators. During the bull market of the late 2000's many of these projects were optioned to other companies, sold or spun-off. A table outlining these exploration project arrangements includes currently optioned and previously sold projects. Many projects have been optioned by other companies but not earned-in on and returned to Eagle Plains, the income/shares and exploration expenditures from these option arrangements are significant but not included in the above mentioned table. This contrarian strategy follows that projects are acquired when they are not in favor and sold or optioned when they are in demand.

Project Generator Model

Eagle Plains project generator strategy focuses on the discovery stage of the exploration-mining continuum which typically provides the greatest opportunity for share price growth. The traditional approach of junior exploration companies is to finance exploration through repeated share offerings which results in dilution. Project generators, on the other hand, bring in a partner that earns an interest in the project by funding exploration. This results in a reduced interest in the project but greatly reduces the risk of exploration. In essence, it is a risk averse approach to exploration.

Eagle Plains utilizes in-house research, TerraLogic Exploration Inc., and a network of prospectors to identify mineral exploration projects, this accounts for the current porfolio of over 35 projects. These were in large part acquired merely for the cost of staking.

Joint Venture Strategy

Eagle Plains risk-averse exploration strategy is to employ joint-venture participation to advance it's portfolio of properties. The intent of this model is to reduce the necessity of EPL share dilution while another company provides exploration funding as part of the option agreement earn-in process on a particular project. A typical option agreement consists of three components;

- commitment to explore between $3-5m over a specified amount of time,

- payment of a number of their shares to Eagle Plains

- payment of a specified amount of cash to Eagle Plains

This joint-venture model reduces exposure to the risk of exploration while maintaining a significant interest in the property and partnering company in the event of a discovery. By combining the consulting services of our in-house technical team with the financial commitments of our partners as they earn-in, we add significant revenue to the treasury and keep our technical team engaged while moving our exploration projects ahead. Click here for a list of option arrangements and their details.

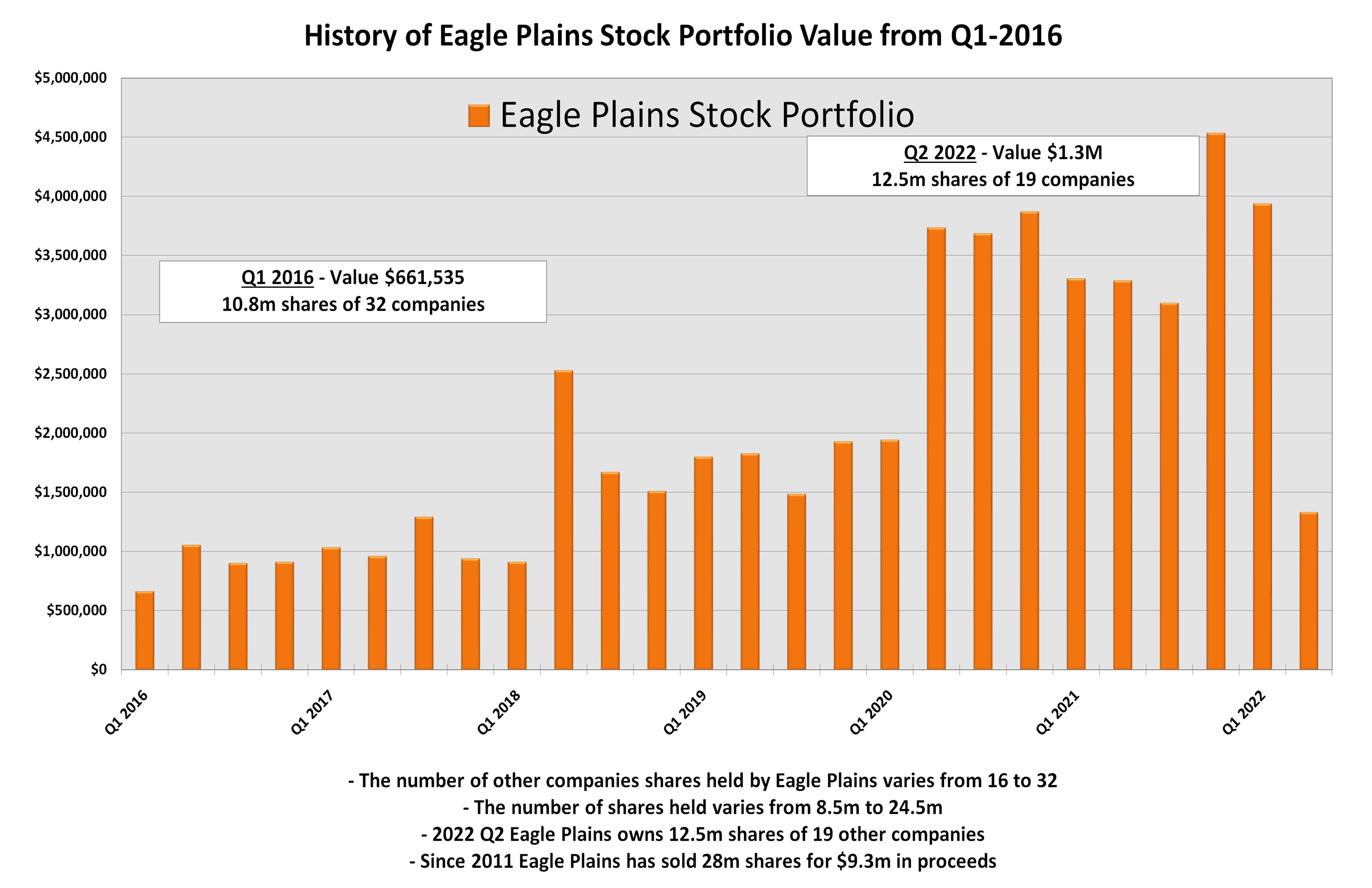

As a result of employing the joint-venture (project generator) strategy, Eagle Plains has amassed a significant portfolio of shares of other companies. The value of this portfolio varies with the market, some significant points are:

- Since 2011 Eagle Plains has sold 12.01m shares for $5.27m in proceeds

- To raise this value through equity financing at 10 cents would have added 52.7m shares to EPL's shares outstanding, not including warrants being exercised

- In 2016 Eagle Plains held 10.8m shares of 32 companies for a value of $661,535

- In Q2-2021 Eagle Plains holds over 23m shares of 15 companies for a value of ~$3m

Below is a graph depicting this growth in stock portfolio value:

Revenue Generation

Revenue is generated by the company in a number of ways. TerraLogic Exploration Inc. is a wholly owned subsidiary of Eagle Plains which employs our technical team. This subsidiary conducts exploration services for Eagle Plains, our partners and 3rd party companies. This work generates significant revenue. Other sources of revenue include cash and share payments made by other companies to Eagle Plains as part of the earning in process of the option arrangements.

Eagle Plains purchased an office building in Cranbrook, B.C. as it's headquarters and leasable commercial office space. This transaction took place during the general realestate downturn that resulted from the economic collapse of 2008. Near the same time Eagle Plains also acquired a farm on the outskirts of Cranbrook and converted it to a geological processing facility, further adding to our revenue generation and reducing the costs to the company for services associated with this.

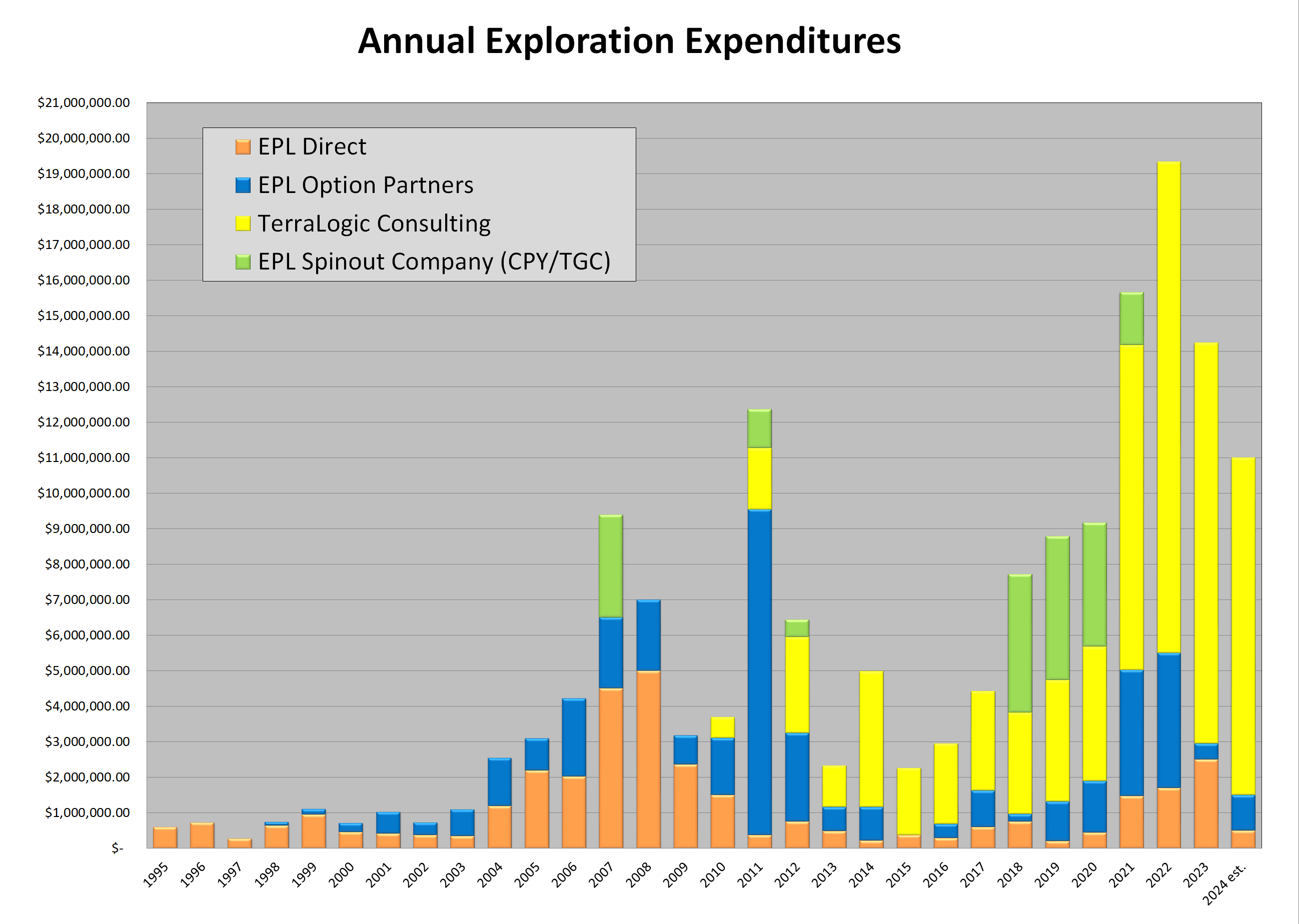

Below is a chart depicting annual exploration expenditures on Eagle Plains projects by Eagle Plains and its option partners. Also included are expenditures on the projects of companies that have been spun-out from Eagle Plains. Finally, the value associated with Terralogic Consulting is the work completed by Terralogic Exploration for third parties, this creates revenue for Eagle Plains but are not expenditures on EPL projects.

Creating Value for Our Shareholders

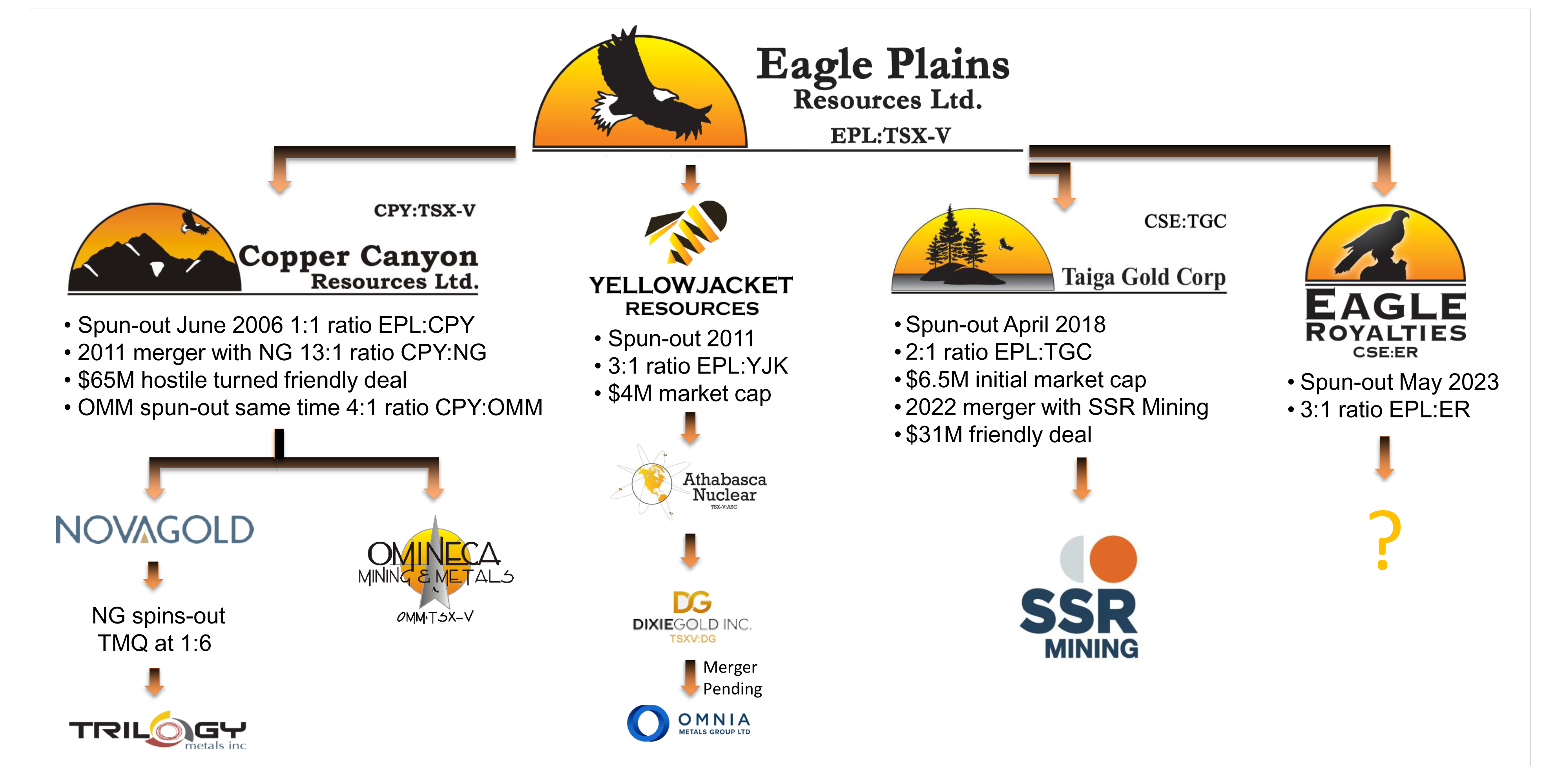

A strategy to create shareholder value is to spin-off successful exploration projects into new companies. This spotlights the value for the market and simplifies the corporate structure for acquisition by other companies. An example of this was the creation of Copper Canyon Resources (CPY) in 2006, Eagle Plains shareholders received this new share on a 1-for-1 basis. CPY was then purchased by NovaGold Resources in 2011, and as part of the arrangement, the remaining assets of CPY were then spun into a new company for the shareholders, Omineca Mining and Metals.

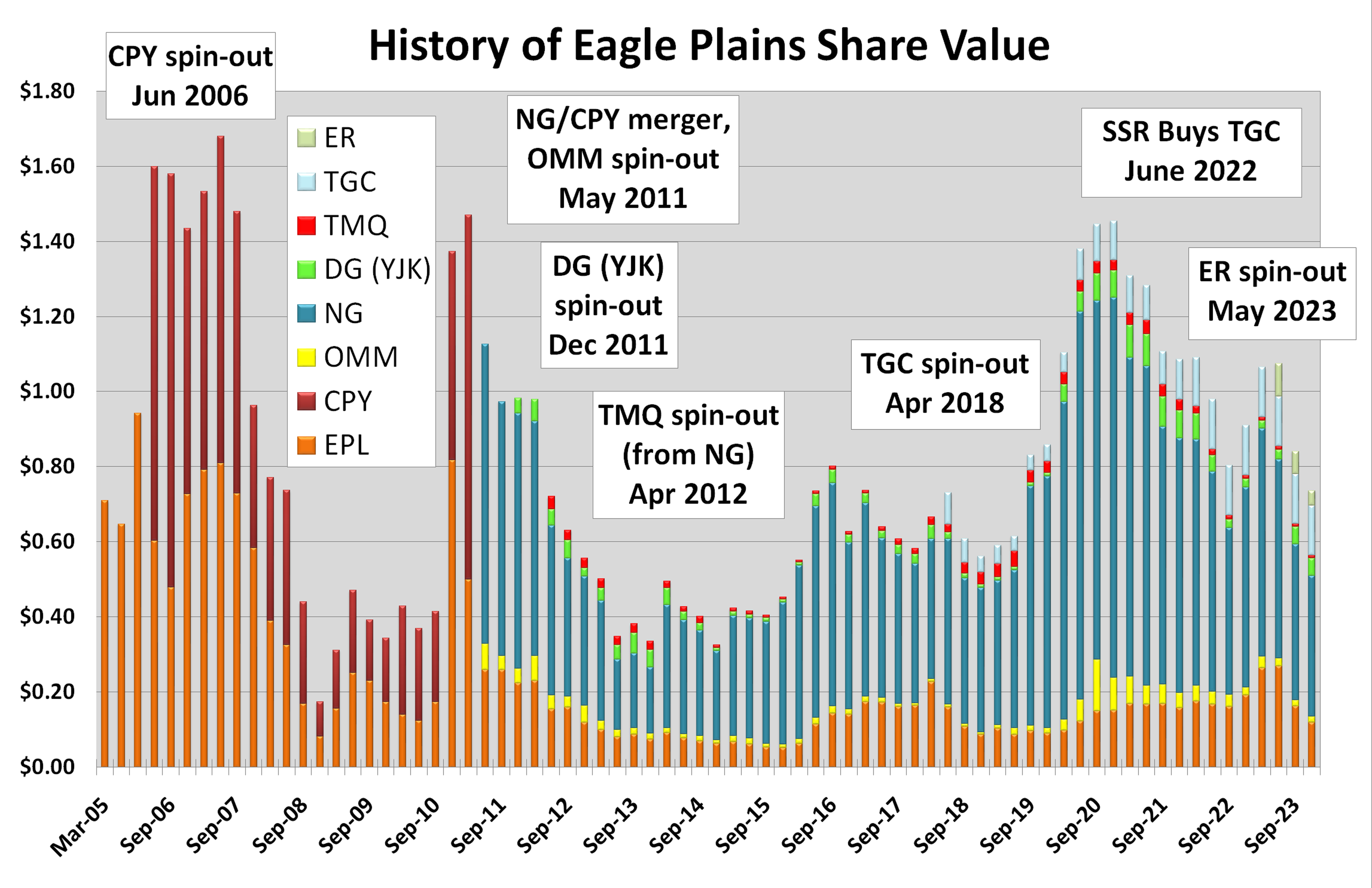

The chart below depicts the value of Eagle Plains shares over the years starting prior to the spin-out of Copper Canyon Resources in June 2006. It includes the proportionate value of all Eagle Plains' spin-outs and their mergers including Copper Canyon, Nova Gold, Omineca Mining, Trilogy Metals, Dixie Gold which was spun-off in December 2011 as Yellowjacket Resources (YJK) and finally Taiga Gold. See notes below chart for details.

Notes:

Notes:

- June 2006 Eagle Plains spins-off it's most developed asset, Copper Canyon, into Copper Canyon Resources (CPY:TSX-V)) on a 1-for-1 share basis to existing shareholders. Only weeks prior to this spin-off Eagle Plains was trading near 70 cents, after the spin-off Eagle Plains continued trading near 70 cents while CPY began trading at $1.02, a 245% gain in value

- May 2011 the Copper Canyon Resources shares were acquired by NovaGold Resources (NG:TSX) on a 13.6 CPY to 1 NG share ratio and CPY shareholders also received a new share, Omineca Mining and Metals (OMM:TSX-V) on a 1-for-4 basis. This arrangement was worth approximately $65 million to Copper Canyon shareholders at the time it was approved

- December 2011 Eagle Plains spins-off Yellowjacket Resources (YJK:TSX-V) on a 1-for-3 share basis to existing shareholders. Yellowjacket came under different management and eventually became Dixie Gold which rolled back the share on a 4:1 basis in January 2020. It was announced in October 2023 that, subject to necessary approvals, Dixie Gold is to be acquired in a friendly takeover by Australian company, Omnia Metals Group. As per the agreement, Omnia is to acquire 100 per cent of the issued and outstanding common shares of Dixie Gold (26,062,188) in exchange for 166,666,667 common shares of Omnia plus $3 million cash.

- April 2012 NovaGold spins-off NovaCopper (TMQ:TSX) on a 1-for-6 share basis which has been renamed to Trilogy Metals Inc

- April 2018 Eagle Plains spins-out Taiga Gold Corp. (TGC:CSE) on a 1 for 2 share basis

- April 2022 Taiga Gold Corp. is purchased by SSR MIning in an all cash deal amounting to approx $31M ($0.265/share)

- May 2023 Eagle Plains spins-out Eagle Royalties (ER:CSE) on a 1 for 3 share basis

Eagle Plains shares trade on the TSX Venture Exchange (TSX-V) under the symbol EPL.

Eagle Plains Spins-Out Eagle Royalties Ltd.

In May 2023, Eagle Plains spun-out Eagle Royalties Ltd. (CSE:ER) to shareholders on a 3 EPL for 1 ER share basis. The spin-out was conducted to maximize shareholder value by::

- allowing Eagle Royalties to pursue strategic opportunities

- improving the identification and valuation of specific royalty interests

- ultimately enabling Eagle Royalties to separately market and develop its various assets while maintaining the ability to acquire additional royalties

Eagle Royalties (CSE:ER) is comprised of over 50 royalties located throughout Western Canada with the flagship royalty being the McQuesten/AurMac Royalty that overlies a portion of Banyan Gold's Aurmac Property and Hecla Mining's Keno Hill Project.

For more information about the spin-out Plan of Arrangement please visit the following links:

- Eagle Plains 2023 Information Circular for the Notice of Special Meeting of Shareholders - April 26th, 2023

- Notification of Notice and Access

- Notice of Meeting

- Form of Proxy

Eagle Plains Spins-Out Taiga Gold Corp.

In April 2018, Eagle Plains spun-out Taiga Gold Corp. to shareholders on a 2 EPL for 1 TGC share basis. The spin-out was conducted to maximize shareholder value by:

- spotlighting the value of several gold exploration properties and the option of its flagship property, the Fisher, to SSR Mining

- simplifying the corporate structure to make these assets readily available for acquisition

Taiga Gold Corp. was comprised of 6 gold projects located adjacent to and in the vicinity of the SSR Mining's Seabee Gold Operation in northeastern Saskatchewan. The company was purchased by SSR Mining in an all cash deal amounting to approximately $31M ($0.265/share) in April 2022. For more information about the spin-out Plan of Arrangement please visit the following links:

- Spin-Out Plan Overview

- Plan of Arrangement Document

- Eagle Plains 2018 Information Circular for the Special Meeting of Shareholders - April 6th, 2018

Eagle Royalties Ltd. Plan of Arrangement - Accounting Information

For accounting purposes the adjusted cost basis (ACB) of the Eagle Royalties Ltd. share is to be 33.54% of the pre-split Eagle Plains share purchase value.

Taiga Gold Corp. Plan of Arrangement - Accounting Information

For accounting purposes the adjusted cost basis (ACB) of the Taiga Gold Corp. share is to be 30.34% of the pre-split Eagle Plains share purchase value.

Yellowjacket Resources (now Dixie Gold) Plan of Arrangement - Accounting Information

In Dec 2011, Eagle Plains Resources spun-out its Yellowjacket Project into Yellowjacket Resources, resulting in a 1 for 3 share split. For accounting purposes the cost basis of the Yellowjacket Resources share is to be 31.58% of the pre-split Eagle Plains share purchase cost. The company has been renamed to Dixie Gold and is now managed by a different management group.

![]() Tax Election Instructions for the Disposition of Eagle Plains Butterfly Shares

Tax Election Instructions for the Disposition of Eagle Plains Butterfly Shares

![]() Yellowjacket Plan of Arrangement Information Circular - 17mb

Yellowjacket Plan of Arrangement Information Circular - 17mb

Copper Canyon Plan of Arrangement - Accounting Information

In June 2006, Eagle Plains Resources spun-out its Copper Canyon, Abo and Severence properties into Copper Canyon Resources on a 1 EPL for 1 CPY share basis. In March 2011, Copper Canyon Resources was purchased by NovaGold in an all share deal amounting to approximately $65M and included the additional spin-out of Omineca MIning and Metals (OMM:TSX-V). For accounting purposes the cost basis of the Copper Canyon share is to be 59.35% of the pre-split Eagle Plains share purchase value.

We have retained an independent & informal opinion of the tax implications to our USA shareholders as a result of the plan of arrangement.

Eagle Plains Resources 2023 Information Circular - for the Annual and Special Meeting of Shareholders to be held on December 7, 2023

![]() Eagle Plains Resouces Annual General Meeting Information Circular 2023

Eagle Plains Resouces Annual General Meeting Information Circular 2023

![]() Stock Option Plan for Eagle Plains Resources

Stock Option Plan for Eagle Plains Resources

Investor Relations Resources

![]() Eagle Plains Corporate Brochure 2024

Eagle Plains Corporate Brochure 2024

Sign up to receive our investor information package for Eagle Plains Resources »

For more information, please contact:

Mike Labach

Investor Relations Manager

Phone 1.866.HUNT ORE / 1.866.486.8673

Email: mgl@eagleplains.com

Updated February 7, 2024